How protected would you be if you were to be involved in a liability lawsuit stemming from an auto accident or incident that occurred at your residence? Most auto and home policies have liability limits included but these do not always offer adequate coverage. When determining the most appropriate limits for your lifestyle, we recommend consulting your financial and estate planner. It’s important to consider your physical assets, invested assets, and future potential earnings, as these are the items that can be sacrificed if you are found negligent in a liability lawsuit and do not have adequate limits of protection.

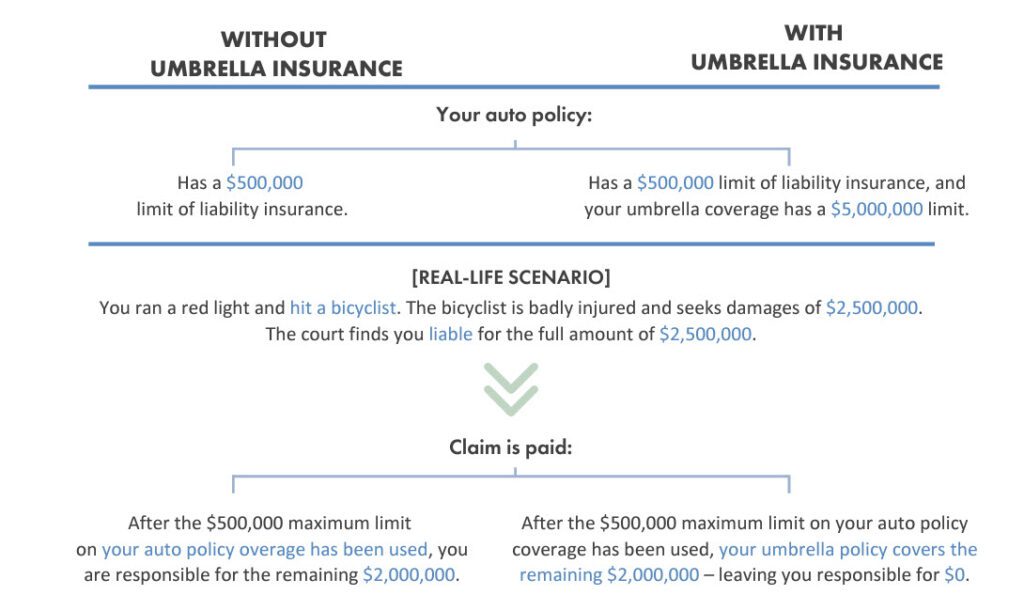

To help protect you and your family from extraordinary financial loss resulting from an auto or property liability lawsuit, we recommend a Personal Umbrella policy. This policy is an additional layer of coverage that is activated once your home or auto liability limits have been exceeded and will pay up to a specified maximum amount.

Here’s a quick look at how umbrella insurance works:

BY THE NUMBERS: Your Chances of Needing an Umbrella Policy.

Liability Claims

- The average size verdict is up 967% from 2010-2018, and when children are involved, verdicts run almost 1700% higher (1). Successful individuals and families are especially vulnerable and viewed as having “deep pockets.”

- Dog bites impact 4.5 million people annually, mostly children, and the average cost per claim is up 132% over the last decade due to increased medical costs (2). Policyholders should understand their policy, as many insurers have dog breed limitations and exclusions regarding dog bites and liability coverage (3).

- The average insurer payment per insured vehicle rose 31% for bodily injury claims (4).

- More people die from injuries sustained in a motor vehicle accident or slipping and falling than any other cause, including cancer and heart disease.

Litigation Trends

- Attorney representation now occurs earlier in the claims process for auto and liability claims.

- Social inflation is driving higher insurer claim payouts and forcing policyholders to pay higher premiums (5).

- Insurance claims that went into litigation rose 47% from 2017 to 2021.

- Legal system abuse is skyrocketing — investors have sunk more than $11 billion into third-party litigation funding aiming for a percentage of final nuclear verdicts (6).

- The average legal settlement amount has risen more than 65% from 2012 to 2022 (7).

- The effects of ongoing nuclear verdicts may significantly increase insurance costs or make specific types of insurance so risky that insurers won’t underwrite policies.

- With adequate protection under an umbrella policy, the insurance company pays for most attorney and litigation fees.

Auto Accidents

- Fatal auto accidents are on the rise after a four-decade downward trend (8).

- 62% of all crash fatalities in 2021 were vehicle passengers (9).

- In 2021, 65% of fatal accidents were caused by general distraction or daydreaming (10).

- Pedestrian deaths have risen 77% since 2010, the highest level in 40 years—and a 31% increase in daytime deaths (11).

With increasing litigation, as well as, settlements or verdicts tallying $10 million and higher, securing a personal umbrella insurance policy can be a small price to pay to protect your assets and future financial security.

Contact our team of private risk management experts to learn more or to see if this is right for you.

Sources:

- American Transportation Research Institute, “Average Verdicts Greater than $1 Million,” July 10, 2020.

- Insurance Information Institute, “Spotlight on Dog Bite Liability,” April 5, 2023.

- Insurance Research Council (IRC), “Trends in Auto Insurance Claims,” February 2019.

- Centers for Disease Control and Prevention, National Center for Injury Prevention, February 28, 2022.

- Law.com, Daily Business Review, “Insurance Litigation Spikes 47%,” July 8, 2022.

- American Property Casualty Insurance Association, PropertyCasualty360, “Nuclear Verdicts Raise Alarm: Preventing Legal System Abuse,” July 11, 2023.

- VerdictSearch, PropertyCasualty360, “They’re Just Killing Us,” April 25, 2023.

- Insurance Institute for Highway Safety, IIHS, “Fatality Facts: Yearly Snapshot,” May 2023.

- Insurance Institute for Highway Safety, IIHS, “Fatality Facts: Yearly Snapshot,” May 2023.

- Insurance Institute for Highway Safety, IIHS, “Fatality Facts: Yearly Snapshot,” May 2023.

- Governors Highway Safety Patrol, “Pedestrian Fatalities by State,” 2022 Preliminary Data.

DISCLAIMER:

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. Baldwin Risk Partners, LLC (“BRP”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. BRP does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, BRP does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser. Baldwin Risk Partners, LLC offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through BRP insurance licensed entities. This material is not an offer to sell insurance.

Comments are closed.