A Favorable Market for RWI

For parties involved in M&A transactions, there is good news in the representations and warranties insurance (RWI) market. Increased insurer capacity, coupled with

a slower M&A market, has led to very favorable RWI policies on a wide variety of transactions. Such attractive terms include:

- Competitive Financial Terms — Both premium pricing and retention amounts have decreased in recent months. Current premium rates for most transactions range from 2.5% to 3.5% of the coverage amount. Initial retentions in an amount less than 1% of enterprise value are often available, even on small transactions.

- Robust Policy Coverage — Insureds are benefiting from policies with broader coverage, such as fewer exclusions, fewer specifically excess positions with respect

to underlying insurance coverage, and fewer deemed changes to the reps in the purchase agreement. - Process Improvements — Many insurers are demonstrating more efficiency in the underwriting process, including shorter underwriting calls and fewer, more

targeted follow-up questions. - Ample Capacity for a Variety of Transactions — RWI is increasingly available for a wide range of transactions, including with respect to deal size and structure. As a result of both available capacity and specialized hires, policies can also be placed for deals in almost any industry.

While financial and coverage terms may readjust when M&A volume increases, the capacity expansion in the market and insurers’ investments in specialization are likely to result in strong interest in underwriting deals in a variety of industries for years to come.

Evolving Industry Trends

BRP recently surveyed RWI insurers to determine their willingness to underwrite transactions in four sectors—healthcare, financial institutions, energy, and vice businesses. We asked underwriters to respond based on industry only, and to set aside any other factors that might influence insurability.

The survey responses reinforced our observation discussed above. Insurers are currently willing to underwrite transactions in a very broad variety of industries. The results of the survey and key takeaways are discussed in the following pages.

Healthcare

Overall, insurers’ interest in transactions in the healthcare sector has significantly increased this year, though appetite varies depending on the type of business and scope of operations. For example, the RWI markets have widespread interest in acquisitions of target companies that manufacture, distribute, or sell medical devices, as well as transactions tied to certain specialties such as radiology, dentistry, and vision. On the other end of the spectrum, acquisitions of home healthcare businesses or nursing homes, or highly complex targets such as hospitals, may face greater headwinds in finding RWI coverage.

Some insurers may require certain exclusions for particular businesses—for example, a product liability exclusion for invasive medical devices. However, exclusions that were once standard for most healthcare transactions—such as medical malpractice—might be removed for certain attractive target companies to make policy terms more competitive.

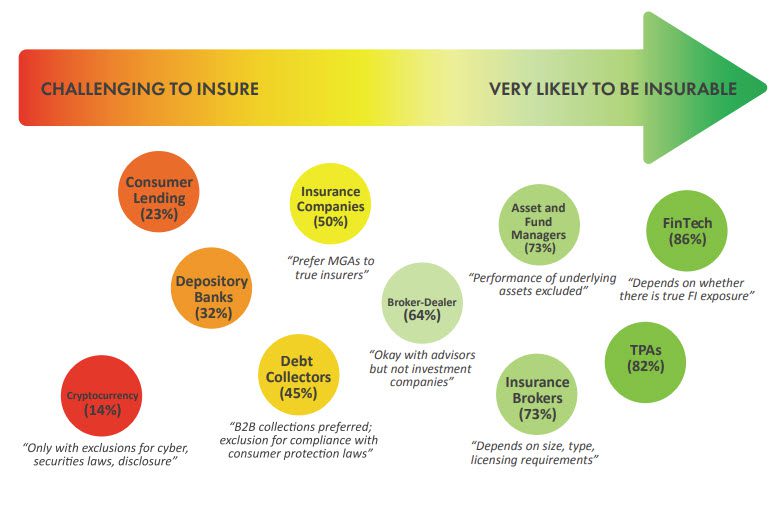

Financial Institutions

Underwriter interest in transactions in the financial sector has also increased—but with a range of appetite based on the type of business and operations. For example, the RWI market is very receptive to fintech target companies and third-party administrator (TPA) businesses. In contrast, almost all insurers are wary of transactions involving cryptocurrency businesses, and any available coverage will require multiple exclusions. It is worth noting that carriers’ limited appetite for acquisitions of depository banks and consumer lending businesses may have declined even further since the survey was conducted as a result of additional challenges faced by regional banks.

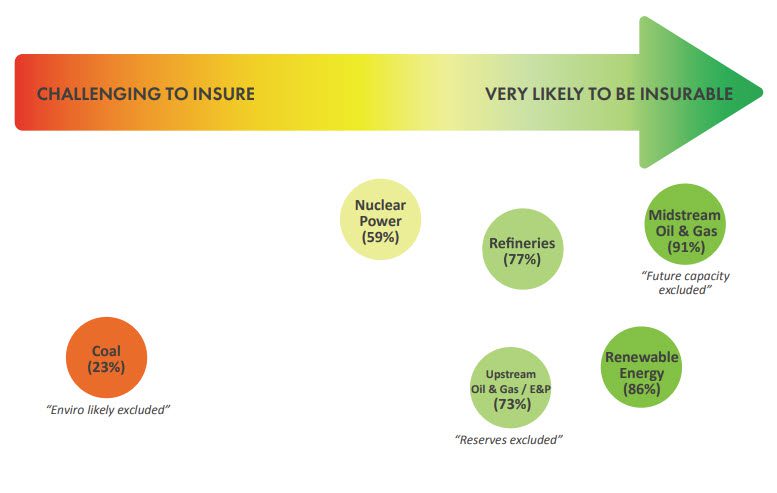

Energy

RWI markets also have broad interest in underwriting policies for transactions in the energy sector, especially for deals involving renewable energy or midstream oil and gas target companies. However, insurers have very little appetite for coal businesses, and to the extent they are willing to offer terms on such transactions, they will likely require exclusions for environmental contamination and pollution.

While coal deals remain challenging, insurers have grown increasingly comfortable with acquisitions of companies in the upstream oil and gas sector, which is a noticeable shift in interest in recent years.

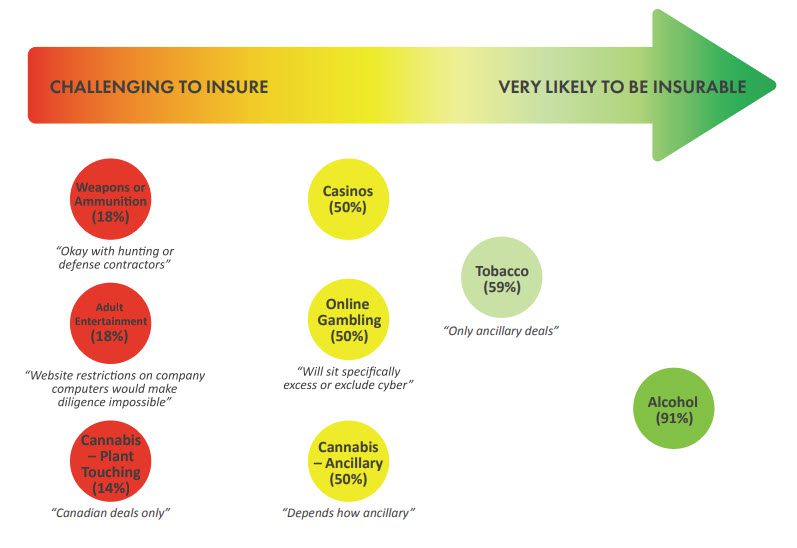

Vice Businesses

Many transactions involving vice businesses will face challenges in finding RWI coverage as a result of legal or regulatory uncertainty and certain political or moral reservations. Interest in plant-touching cannabis deals is very low and is not expected to expand, absent a change in federal law. Appetite for businesses such as gambling or tobacco is mixed. However, transactions involving alcohol companies are the exception in this category and are likely to find a welcoming RWI marketplace.

Research Disclaimer

BRP’s survey of insurers was completed in April 2023 and includes responses from 22 markets. Market interest is subject to change, as a wide range of dynamic factors continually impacts underwriting decisions. Responses were only meant to express a general willingness to consider underwriting a deal in a particular industry. Actual insurability of a particular transaction is entirely subject to a review of the details of a target company’s operations, the terms of the transaction, and a variety of other factors. Quotes included in survey results are paraphrased for brevity and may only reflect the view of a single market. They should not be viewed as representing the full market. To learn more about the BRP Private Equity team and how we can help you develop strategies to mitigate risks associated with mergers and acquisitions, please reach out to a member.

To learn more about the BRP Private Equity Team and how we can help you develop strategies to mitigate risks associated with mergers and acquisitions, please reach out to a member.

Lidore DeRose | Senior Partner, SVP Transaction Risk

917.969.2300 | lidore.derose@baldwinriskpartners.com

Travis Holt | Senior Partner, SVP Private Equity

210.896.3101 | travis.holt@baldwinriskpartners.com

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. Baldwin Risk Partners, LLC (“BRP”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. BRP does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete.

Furthermore, BRP does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

Baldwin Risk Partners, LLC offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through BRP insurance licensed entities. This material is not an offer to sell insurance.

Comments are closed.