Download the Oil and Gas SOTM Here

Executive Summary

The oil and gas industry is at a critical inflection point: With demands to transition to clean and green energy, how do oil and gas producers fit into the picture? Though we might not have a clear answer to that question, it is clear that the oil and gas industry powers the world we live in, and this will likely be the case into the near future. As the industry is coming to a head with existential questions, it must also address key challenges to continue to meet global energy demands.

2023 is showing no signs thus far that persistent issues such as geopolitical unrest, supply chain issues, inflation, natural disasters, and material shortages are likely to abate. Additionally, rising costs and project delays driven by the Ukraine conflict, supply chain disruption, natural disasters, trade policy, labor shortages, and global inflation are challenges that will likely continue to impact the oil and gas industry. The oil and gas industry is also having to grapple with decreasing capacity within the insurance market.

Certain insurance carriers in primary and secondary markets are significantly limiting the amount of oil and gas business they underwrite in response to growing pressures to diminish global dependency on oil and gas by transitioning to more sustainable energy sources, such as solar, wind, and hydrogen.

Just as the energy sector is having to manage a slew of unfavorable conditions, so too are primary and secondary insurers. Because of sustained negative underwriting results across many lines of coverage, the insurance market has hardened. This means premiums are higher, carrier capacity is diminished, and underwriting scrutiny is heightened. Unfortunately, the hardened insurance cycle is likely to persist in the foreseeable future.

Though these challenges might not have clear cut solutions, oil and gas companies remain resilient and can capitalize on key areas of opportunities. For example, many oil and gas companies started 2023 with healthy balance sheets. This presents an opportunity for producers to strike a balance between increasing investments in renewable energy and maintaining capital discipline in the face of overarching economic pressures.

From an insurance and risk management perspective, the oil and gas industry is complex and supported by a complex overlay of insurance products. Oil and gas will still be with us for many years, though climate change is driving the energy transition from oil and gas to renewable energy. With areas of opportunity hampered by layers of risk, oil and gas companies need to protect their operations, investments, and assets with the proper insurance coverage, loss prevention controls, and risk management strategies.

As the oil and gas sector confronts global disruptors and fundamental changes, working with an experienced advisor can help organizations address the challenges they face and obtain critical financial protection for their business operations so that they’re able to focus on investing in growth.

Industry Challenges

Though the oil and gas industry is no stranger to supply disruption and price volatility, the current confluence of issues the industry faces is unique. Economic, geopolitical, social, policy, and financial pressures are reshaping the energy market at large. Energy security, affordability, and sustainability all form a part of this dynamic, and each is currently in a state of flux.

The immediate result of this dynamic is high energy prices, which have resulted in high cash flows and healthy balance sheets for oil and gas companies. Where and how the industry chooses to invest in the future is uncertain, especially in light of overarching economic uncertainty.

As the lifeblood of the global economy and a pillar of national security, the oil and gas industry faces a host of significant, entrenched challenges that create great risk for companies in the space.

Geopolitical conflict

As the Russia-Ukraine war continues to unfold, its full repercussions remain to be seen. In the short term, the conflict has worsened supply chain bottlenecks and contributed to ballooning global inflation. The war also had an immediate impact on energy markets around the world, most notably in the European Union. Though increased demand led to price spikes that padded oil and gas companies’ profits, a geopolitical conflict of this caliber poses a risk to global energy security.

Economic pressures

Inflation is high in all parts of the world, and for oil and gas companies, this increases operational and investment costs. For example, according to Bloomberg¹, in 2022 the price of drill pipe increased 90% to a record $4,150 per short ton compared to $2,300 in 2021. One of the positives is that there is a correlation between oil prices and inflation, with high inflation historically aligning with higher oil and gas prices. This leads to more profits for oil and gas companies—that is until prices are too high and dampen demand. Though many companies in the industry currently have healthy financials, the volatile nature of oil and gas prices is a substantial risk in and of itself because of the uncertainty it creates.

Persistent supply chain issues

Supply chain issues also impact operations and profitability within the oil and gas industry. There have been months-long delays in securing steel pipes and casing for drilling, with supply chain issues also driving up the cost of raw materials and goods. This problem also greatly impacts the transportation sector, which supports oil and gas companies, as parts needed for vehicle repairs are harder to come by. Additionally, the ways in which supply chain issues affect oil and gas projects shapes their profitability and predictability.

U.S. Job Vacancies

Extreme weather events

2022 was yet another year plagued by extreme weather events, with 18 climate disaster events surpassing the $1 billion mark in damages in the United States alone, amounting to $165 billion in insured and uninsured losses⁴. And the oil and gas industry is extremely susceptible to the impact of these events. For example, the Gulf Coast is home to many refineries and is in the path of major tropical storms. Hurricanes are the costliest natural disaster, and within the context of oil and gas production, they can greatly damage infrastructure and shut off production. Though this is but one example, natural disasters of all varieties have the potential to create huge losses for oil and gas operations that fall within their path.

Renewed focus on ESG

Because of a renewed focus on environmental, social, and governance (ESG) initiatives and policies, regulatory bodies and consumers pressure investors to demonstrate their commitment to energy transition and decarbonization. The way materials are sourced and at what level of carbon content are now more important to a greater number of people, including insurance carriers, shareholders, lenders, and other stakeholders. However, stakeholder positions on ESG issues are inconsistent and reporting standards are becoming increasingly burdensome, which can make

them difficult to navigate for oil and gas companies.

Cybersecurity threats

The Colonial Pipeline ransomware attack in 2021 quickly became the poster child for cybersecurity breaches in the oil and gas industry. Unfortunately, this is but one of many cybersecurity incidents that have hit oil and gas companies in recent years. Cyberattacks have grown as a threat to the oil and gas industry, with 2022 showing the greatest activity of successful cyberattacks on the sector, according to S&P Global Platts Oil Security Sentinel⁶. Because oil and gas are part of the critical infrastructure that supports modern economies, they are particularly attractive to cybercriminals, especially state-sponsored malicious actors during times of geopolitical transgressions (the Russia-Ukraine conflict).

Regulatory landscape

For oil and gas companies, meeting regulatory compliance is a multi-faceted process that often requires meeting the standards of several governing agencies. Adding to the complexity of this process is the fact that regulatory requirements continuously change in different locations, multiplying the amount of work needed to stay compliant. The oil and gas industry is heavily regulated, and these regulations have only intensified over the years. When oil and gas companies are noncompliant, they can face production delays, legal action, fines, and loss of assets.

Divestiture from oil and gas

Every oil and gas company will be affected by the energy transition, which means all parts of the industry need to know how to respond. The shift to a low-carbon economy exposes oil and gas companies to energy transition risk. Oil and gas companies are facing increasing demands to clarify how the energy transition impacts their operations and business models and their role in changing the energy economy while still having to meet shortterm global demands for energy. From an insurance and risk management perspective, oil and gas companies with “dirty” risks and weak climate transition plans will likely find it difficult to find coverage at good terms, if at all.

Key Areas of Opportunity

Though the oil and gas industry faces significant pressures and risks, key areas of opportunity provide avenues through which companies can weather the storm.

Healthy balance sheets

In 2022, oil and gas companies were able to shore up significant profits as a result of price increases spurred by increased global demand stemming from economies reopening from the COVID-19 pandemic, and then the Ukraine conflict. These profits allowed many companies to fund spending out of earnings and still return capital to shareholders. Because of overarching economic uncertainty and the volatility of energy prices, oil and gas companies will likely continue to practice capital discipline and focus on strengthening their balance sheets. Fortunately, profits earned in 2022 provide ample cash flow that companies can use to fund their strategies through 2023 and beyond.

U.S. Operators: deleveraging down, distributions up

Energy transition

The energy transition presents both a challenge and opportunity to the oil and gas industry. Companies that can realign their business models to fit the new low-carbon reality are likely to find enormous opportunities in the energy transition. The oil and gas industry has to strike a balance between successfully operating their legacy businesses and adapting to a changing policy and investment landscape that demands decarbonization efforts. Oil and gas companies stand to play a significant role in securing the energy transition as the resources and skills within the industry are needed to help meet emission-reduction goals and scale up technologies.

Carbon capture, utilization, and storage (CCUS)

To navigate the challenges of the energy transition, the oil and gas sector has the opportunity to support and invest in decarbonization technologies, such as CCUS. Though oil and gas companies are likely to prioritize capital discipline over major investment activity, CCUS might be a viable investment as producers may be able to gather Inflation Reduction Act capital. Improved incentives provided by the Inflation Reduction Act increase the U.S. federal income tax credit under IRC Section 45Q⁹ available for CCUS projects. Investing in CCUS projects and scaling them alongside existing assets also allows oil and gas companies to differentiate their value proposition to customers and investors.

Investments in natural gas

Following Russia’s invasion of Ukraine, energy policy in the U.S. began to pivot. For natural gas, government policy has shifted from phasing out its production to reducing the emissions from natural gas while cleaner alternatives are developed and able to support global demand. As such, investments in natural gas are likely to grow in 2023. Natural gas production is also seeing support from the Inflation Reduction Act, which increased offshore oil and gas lease sales, as well as offering grants to oil and gas companies to monitor and reduce methane.

Insurance Market Outlook

Primary Insurance Market Capacity

Capacity for the oil and gas industry will vary greatly depending on the asset type and portfolio. On the downstream side, there have recently been a few significant shock losses that are negatively impacting capacity, with midstream losses also being particularly heavy. For upstream operations, loss records have remained relatively stable. Overall, well-engineered risks are likely to see carrier appetite, while insureds that experience attritional losses will find it challenging to procure and place coverages.

Oil and gas companies also need to be aware of the constriction of business interruption volatility clauses. Because of the Ukraine conflict, ballooning inflation, and overarching uncertainty in recent years, some insurers are beginning to include restrictive language around volatility clauses for business interruption coverage, which could potentially lead to coverage gaps in the event of a claim.

Insurers are more likely to favor insureds with a strong ESG stance and climate transition plan and less likely to favor companies with less ecologically sustainable risk profiles. In order to maximize the pricing, limits, and terms for coverage from insurers, buyers will need to demonstrate with clear evidence their sustainability credentials and/or their transition plans.

Additionally, insurance carriers are developing strategies and risk models to create capacity for carbon capture operations, as this is likely to be a growing area of business in the near future. With 41 primary and secondary insurers having withdrawn or reduced coverage for coal projects from 2017 to 2022¹¹, this might create more capacity for carbon capture operations, though this will likely lead to rate increases for “dirtier” oil and gas businesses.

It is important to remember that just as insureds are having to grapple with growing operational costs and risks in the face of unpredictable global events, so too are insurance companies. Continuous negative underwriting results have caused the property and casualty (P&C) market to harden, which means premiums are higher, carrier capacity is diminished, and underwriting scrutiny is heightened.

Why the P&C Market Has Hardened

Economic pressures, such as inflation and the threat of recession, make it difficult for insurers to maintain pricing and keep pace with unpredictable loss patterns. In a high inflationary environment, loss expenses increase, which can result in higher loss ratios for insurers. Furthermore, insurance companies are as susceptible as all businesses to the threat of a recession, which economic experts fear is on the horizon due to rising interest rates, sustained labor challenges, and reduced economic activity.

Supply chain disruptions brought on by increased demand and slowed production during the COVID-19 pandemic continue and are exacerbated by labor shortages and geopolitical conflict. Supply chain issues have led to a shortage of raw materials. This creates construction project delays, drives up rebuilding costs, and increases losses for insurers.

Persistent labor shortages and an aging workforce in key industries, including construction, manufacturing, and transportation, worsen supply chain issues. Labor shortages in the construction industry means that there are fewer available workers to meet labor demands in regions that experience severe losses due to extreme weather events. To attract and retain talent, employers are raising wages, which is another factor contributing to growing construction costs. Insurers are struggling to adapt risk models to account for growing wages in this sector.

Geopolitical unrest has had far reaching consequences, particularly the Russia-Ukraine conflict. This war has further hampered an already strained supply chain. Additionally, international conflicts also heighten cybersecurity concerns for businesses and threaten a cyber insurance market with limited capacity.

Extreme weather events are reshaping the world as we know it. Because insurance companies look to past events when calculating risk and pricing coverage, they are struggling to keep up with the impact of unpredictable weather events. The insurance industry has yet to adapt underwriting strategies and climate models to the new era of extreme weather events. Recurring natural disasters amount to an increased severity in insurance claims, and when insurers experience year after year of high loss patterns, this threatens their ability to remain solvent.

Nat Cat Loss Events 2022

Natural catastrophes caused overall losses of $270B worldwide

Social inflation is a term that describes the rising cost of insurance claims as a result of societal trends, such as increased litigation, plaintiff-friendly legal decisions, broader contract interpretation, and larger jury awards. This trend has ushered in the era of nuclear verdicts, with insurers having to foot the bill for litigation and multimillion dollar jury awards

What Can Insureds Expects From the Current

Though the primary insurance market is feeling pressures from many directions and responding accordingly in a manner that energy companies are having to navigate, the availability and terms of coverage for insureds will vary greatly by insurance line, asset type, loss history, and implementation of loss controls. Here is what buyers should expect from the current market:

Intensified focus on valuations

Seesawing replacement costs, as a result of inflation, supply chain issues, and labor shortages, have made it challenging for insurers to properly price coverage, resulting in significant losses year over year. The collision of these factors paired with the trend of insureds undervaluing assets or failing to update the value of assets has made insurers zero in on valuation of assets during the underwriting process. Insurers hope that this will help them improve modeling and price coverage more accurately so that they are able to improve loss ratios. However, insurer replacement costs are projected to increase between 4.5% and 6.5% in 2023¹⁴.

Evidence of loss controls

With increased underwriting scrutiny, insureds need to take the necessary steps to implement loss controls within their business operations. Underwriters will want to see documentation that paints a clear a picture of the risk they are taking on and will ask for evidence of both proactive and reactive loss controls that insureds have implemented. Proactive loss controls mitigate future risks and prevent claims from happening, while reactive loss controls are the plan of action insureds take in the event of a loss to prevent similar events from happening again in the future.

Relationships with insurance companies matter

Building and investing in a relationship with insurers over the years pays dividends in a hardened insurance market. Clear and active communication with underwriters throughout the underwriting process is especially crucial for insureds with complex risk profiles, as meaningful conversations are more likely to result in favorable coverage terms. Companies that demonstrate they have invested in building a culture of risk management are likely to cultivate positive relationships with underwriters, which may also put insureds in a better position to negotiate policy terms.

Natural catastrophes limiting capacity

2022 global insured and uninsured losses amounted to about $270 billion¹⁵, following $320 billion in total losses in 2021. Year after year of high losses means that insurers are retreating from riskier markets, making it increasingly difficult for insureds to find Nat Cat coverage. And when coverage is available, insureds in disaster-prone areas are seeing exorbitant rate hikes, restrictive terms and conditions, higher retention levels, and an overall reduction in limits. Experts predict a 10% to 25% increase in commercial property insurance premiums¹⁶ in 2023, though this number may be higher for property in disaster-prone areas.

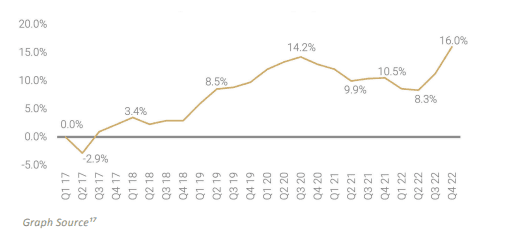

Premium Change for Commercial Property, 2017 – 2022

Auto liability rate hikes

Commercial auto insurance continues to be a challenging market. Loss severity has risen substantially because the cost to repair damaged vehicles has escalated due to inflation, supply chain issues, and nuclear verdicts. Additionally, with newer vehicles being equipped with modern technology, like sensors, computer chips, and cameras, this also increases repair costs. Commercial auto rates rose 7% in Q4 of 2022¹⁸, with rate increases expected to reach up to 10% in 2023¹⁹.

Workers’ compensation remains stable

Amidst overarching turmoil, workers’ compensation remains stable and has ample capacity, with rates continuing to drop. In the U.S., average premium renewal rates declined 1.48% in Q4 2022 on top of a 1.08% decrease from the previous quarter.

Excess liability pricing pressures

Excess liability layers are experiencing pressure from social inflation, which has resulted in growing jury awards. Rate increases averaged 9.6% in Q4 2022²⁰, though riskier profiles will see higher pricing increases.

War and terror exclusions

As the Ukraine conflict continues into its second year, insureds need to be aware of exclusionary language related to the war, and any new exclusions that insurers might be imposing as a response to this conflict. Throughout 2023, companies that purchase standalone terrorism and political violence coverage can expect rate increases of at least 20%. This is due to the civil unrest and wars that have plagued the world the past years²¹.

Reinsurance Market Capacity

Even the reinsurance market is feeling the impact of macro socioeconomic trends. Unrelenting claims from catastrophic natural disasters, the threat of climate change, sustained high inflation, oscillating repair and construction costs, and the Ukraine conflict are impacting reinsurers’ position. Here is how the reinsurance market is responding to the following issues.

Natural Catastrophes

Rampant inflation and the known and unknown fallout from climate change present capital challenges for reinsurers. Additionally, investors have been fleeing to other investments with higher potential returns. With extreme weather events showing no sign of slowing down and the threat of recession looming overhead, these issues are likely to worsen.

Additionally, projections from catastrophe models have claim expenses increasing up to 30% due to the growing cost and availability of materials and labor, among other factors. Due to the growing number and cost of losses across the U.S. and the number of poorly capitalized insurers in geographic areas that have seen continuous natural disasters, reinsurers are expected to bear the brunt of these extreme events.

Premium increases from reinsurers in 2023 are a result of inflation and record-breaking natural catastrophe losses. Reinsurance rate increases for property catastrophe business have averaged 37%²³, according to Howden’s index.

Ukraine Conflict

As of January 2023, many reinsurers have pulled back from underwriting risk in Russia, Ukraine, and Belarus. Reinsurers have seen sharp losses from the Ukraine conflict. Losses are being felt by primary insurers related to this event, specifically related to political violence, war, and terrorism, and impacting reinsurers’ position. In addition to losses, reinsurers also want to avoid the risk of sanctions. Reinsurers’ decision to pull back from war-related risks has also motivated some primary insurers to exclude claims linked to the war in Ukraine. As an example, in December of 2022, 12 of the 13 shipping insurers²⁴ who comprise the International Group of Protection and Indemnity Clubs announced that they would no longer cover Russia-Ukraine war risk exposures.

Withdrawals from oil and gas business

In October 2022, the world’s largest reinsurer Munich Re announced its plans to withdraw from underwriting and investing in new oil and gas fields, new oil-fired power plants, and new midstream infrastructure starting April 1, 2023²⁵. Reinsurer Chaucer also announced in October 2022 its plans to exit the downstream energy market to focus on upstream and midstream business. Though the effects of both of these withdrawals are yet to be seen, they will be very likely to negatively impact overall market capacity and lead to rate increases.

Managing the Overall Cost of Risk and Insurance

Though a hardened insurance market is undoubtedly difficult to navigate, current market conditions also highlight the importance of being as proactive as possible in managing the overall cost of risk to get the best underwriting results from insurers. Implementing these strategies pays dividends in good times, and especially in challenging times.

Because of market conditions, it is also important for you to build a relationship with an experienced broker who understands the complexities of the energy industry. Working with our team of experts can help you determine where you are most financially susceptible to exposures and which loss controls you should implement to protect your assets and investments.

Consider Taking the Following Steps to Help Manage the Overall Cost of Your Risk and Insurance:

1. Identify your risks and understand how they impact your cash flow

In order to know how to mitigate your risks and how you can best use insurance to financially protect your business, you need to identify the exposures your organization faces and the financial consequences should you fail to address them. Quantifying risk in dollar amounts empowers you to invest intelligently in loss controls and properly structure coverage to avoid coverage gaps and overlaps. This process also helps you see areas where you might be able to transfer risk to vendors or subcontractors.

2. Regularly conduct risk assessments

Because risks take all shapes and forms and come from many directions, regularly conducting risk assessments better positions your company to adapt to the constantly evolving risk landscape that characterizes the world today. When any of your operations or assets change, so do your risks. Communicate with your trusted advisor to ensure that insurance coverages align with these changes as they happen.

3. Reconcile all valuations

Insureds and brokers need to confirm all assets are measured accurately because most insurers are now requiring higher replacement cost values for the assets they insure due to inflation and seesawing replacement costs. Staying on top of the valuation process can also improve negotiation leverage in the market.

4. Evaluate your risk tolerance

Understand how much coverage you’re purchasing and how deductibles impact your liabilities. Ask your advisor to evaluate creative program structures, like deductible buydowns, deductible indemnity agreements, deductible reimbursement policies (captive), and parametric insurance (loss mitigation). If you have a higher risk tolerance, you may be able to lower premiums after reviewing for financial feasibility.

5. Invest in loss controls and risk mitigation strategies

Investing in loss controls has upfront costs, but this investment is usually insignificant compared to the financial burden of a loss. Underwriters want to see that both proactive and reactive measures are in place. Proactive loss controls are the actions you take to prevent claims from happening. This can take the form of using telematics for your auto fleet, or regularly educating your employees about safety on the job. Reactive loss controls are the corrective measures you take as a response to loss to prevent similar events from happening again in the future. For example, if you experience a cyber breach, what actions will you take to prevent a similar breach from happening in the future?

6. Vet all vendor relationships

Understand how contracting with other parties can create risk for your business and then find ways to reduce this risk. Most companies rely on third-party service providers and vendors to support their business, and they introduce layers of risk to your organization. This can take the shape of cyber risk, supply chain risk, and more. When you are entering an agreement with vendors and service providers, all involved parties need to think about how contractual risk fits into the picture.

7. Be prepared for your renewal

Do not wait until the last minute: begin preparing for your renewal at least four months before coverage is bound. Develop and document a strategy to keep yourself and your advisor accountable throughout the renewal process so that you are able to do everything within your power to get the best terms from insurers. Work with your advisor to hold stewardship meetings to keep everyone informed of current market conditions and what to expect at renewal.

8. Prepare a narrative underwriters will understand

The underwriting data you provide to the market needs to be complete and easy to understand. In many cases, tailoring the data for input into various underwriting models will help expedite the process and result in a better outcome. Although it is not always the case, generally the price underwriters charge for uncertainty is greater than if they know the full scope of an account’s history and all underwriting information is provided in a user-friendly manner.

9. Demand a thorough coverage analysis from insurers

Both you and your advisor should have full policy forms and endorsements on file. Doing an audit of all policies ensures coverages are adequate and meet your goals. In a hard market, insurance companies will look to include endorsements and policy language that remove previously included coverages. Be sure to address all policy changes.

A Dependable Advisor Relationship

Quantifying your risks and knowing which loss controls and coverages are worth investing in is challenging. Our energy experts have seen countless scenarios play out and can help you determine what your risks are, provide resources to help you improve how you approach exposures, and find insurance that meets your needs as they evolve. We know how to put you in a position where underwriters are more likely to see your risk profile in a favorable light.

Our goal is to become an extension of your team and deliver risk mitigation strategies and insurance architecture that align with your goals from day one. In addition to helping with the implementation of loss control strategies that help manage the overall cost of insurance, here are other ways we help clients in the energy industry:

1. Keeping you abreast of market changes

We stay abreast of market changes so that you don’t have to and communicate how changes to underwriting standards impact your coverage.

2. Access to global markets

Our team has access to global markets and knows how to align insurance coverage and risk mitigation coordination for global operations. We have strong, long-term relationships with the world’s top energy insurance carriers

3. A consultative approach

In order to be as effective as possible, we shape our strategy around your business goals, needs, and values as they evolve. It’s our job to learn this information from you and adjust our approach to the insurance purchasing and risk mitigation process accordingly.

4. Collaborating with lenders

We help facilitate the conversation with lenders about how insurance fits into the transaction lifecycle for the projects in which you invest. Our experts provide guidance about risk mitigation at all stages of projects and help you communicate with lenders about insurance protects investments and enhances profitability.

5. Tailoring your insurance program

Determining the right coverages and limits for complex operations requires the highest level of expertise. With 35 team members averaging 20 years of industry experience, our team knows how to tailor insurance programs for clients’ unique needs.

6. Loss control services

We provide insights and access to resources that reduce the likelihood of claims from occurring. Our goal is to establish a culture of risk management that prioritizes safety, compliance, and education, so that our clients can manage their exposures, stay ahead of the competition, and protect their most valuable assets.

7. Providing detailed claims analysis

Our in-house team of advocates helps expedite and manage the entire claims process so clients can maximize recovery and reduce their cost of risk. We identify what caused a claim to happen and provide recommendations about risk mitigation strategies to reduce the severity of claims in the future.

With underwriting scrutiny at an all-time high and insurers providing less favorable terms for coverage, now’s the time to work with a team of experts with a proven track record in the energy industry. Contact our energy team today to learn more about how we can help you assess your risks and protect your assets and investments

¹ Javier Blas, Hottest Commodity in the Oil Industry: Elements, Bloomberg, August 31, 2022

² Reliable energy requires resilient supply chains, Accenture, July 29, 2022.

³ Tu Nguyen, Labor shortage remains a major challenge for oil and gas: Spring 2022 outlook, The Real Economy Blog, Feb 7, 2022

⁴ NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2023).

⁵ NOAA, Ibid

⁶ Energy security sentinel cyberattacks surge in 2022 as hackers target commodities, S&P Global Commodity Insights, Oct 10, 2022

⁷ Tom Ellacott, Oil and gas companies will recalibrate strategies in 2023, Wood Mackenzie, December 14, 2022

⁸ 2023 oil and gas industry outlook Investing in the future of energy, Deloitte, 2023

⁹ Greg Matlock, Why carbon capture just became an economic fastball, Ernst & Young Global Limited, Nov 15, 2022

¹⁰ 2023 oil and gas industry outlook Investing in the future of energy, Ibid

¹¹ 2022 Scorecard on Insurance, Fossil Fuels and the Climate Emergency, Insure Our Future, October 19, 2022

¹² Commercial property/casualty market index, CIAB, Q4 2022

¹³ Climate change and La Niña driving losses: the natural disaster figures for 2022, Munich RE, January 10, 2023

¹⁴ Loretta Worters and Jeremy Engdahl-Johnson, Inflation, Catastrophes, and Geopolitical Risks Weigh on 2022 P&C Industry Results,

New Triple-I/Milliman Report Shows, Insurance Information Institute, February 7, 2023

¹⁵ Climate change and La Niña driving losses: the natural disaster figures for 2022, Ibid

¹⁶ Insights into the 2023 Commercial Property Insurance Market | Property & Casualty, CBIZ

¹⁷ Commercial property/casualty market index, Ibid

¹⁸ Ryan Smith, US commercial insurance rates rise in Q4, Insurance Business Magazine, Jan 9, 2023

¹⁹ Jeff Cavignac, What to Expect for the Commercial Insurance Market in 2023, Risk Management, November 21, 2022

²⁰ Commercial property/casualty market index, Ibid

²¹ Claire Wilkinson, Worldwide events hit political violence market, Business Insurance, February 1, 2023

²² Commercial property/casualty market index, Ibid

²³ Steve Evans, Renewals: Catastrophe retro rates +50%, global property cat +37%, Howden, January 2023

²⁴ Alex Longley and Alaric Nightingale, Shipping insurers moving to exclude Russian-Ukraine war claims, Property Casualty 360,

December 29, 2022

²⁵ New Oil & Gas investment / underwriting guidelines, Munich Re, Accessed March 10, 2023

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. Baldwin Risk Partners, LLC (“BRP”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. BRP does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, BRP does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

Baldwin Risk Partners, LLC offers insurance services through one or more of its insurance licensed entities. Each of the entities

may be known by one or more of the logos displayed; all insurance commerce is only conducted through BRP insurance

licensed entities. This material is not an offer to sell insurance.

Comments are closed.