Welcome to the November 2023 issue of the Baldwin Bulletin – a monthly guide to important legal news and employee benefits-related industry happenings, designed to keep you abreast of the latest developments.

This month’s issue of the Baldwin Bulletin focuses on providing employers with important compliance deadlines, as well as certain compliance issues that will potentially have a significant impact on employers for the remainder of 2023.

Upcoming Compliance Deadlines

Employers must comply with numerous reporting and disclosure requirements in connection with their group health plans. Please note the following deadlines for the remainder of 2023, available here.

Enforcement Safe Harbor for Prescription Drug Machine-Readable File Requirement Rescinded

On September 27, 2023, the U.S. Departments of Labor, Health and Human Services, and Treasury (Departments) issued FAQs Part 61, in which it rescinded two non-enforcement policies, including one with respect to the requirement in the Transparency in Coverage Final Rules (TiC Final Rules) for the posting of machine-readable files related to prescription drug pricing.

Employer Action Items

Plan sponsors that have relied on the Departments’ delay with respect to the prescription drug machine-readable file requirements (for in-network negotiated rates and historical net prices) and the associated delayed enforcement will now have to take steps to become fully compliant and should work with their carrier or TPA to confirm compliance (in writing). Plan sponsors of non-grandfathered health plans should also be on the lookout for additional guidance from the Departments to address technical requirements and an implementation timeline. To be clear, this is a totally separate requirement from the RxDC report required under the Consolidated Appropriations Act, 2021 (CAA).

Summary

The non-enforcement policies were originally announced to accommodate certain health plans that were unable to comply with the requirements in the TiC Final Rules regarding the publishing of in-network rates for certain reasons specified in the policies. In addition, there was delayed enforcement of the prescription drug machine-readable file requirement pending an assessment as to whether there was sufficient overlap between the requirements in the TiC Final Rules and the reporting requirements in the CAA.

As a result of the rescissions, going forward, the Departments intend to exercise enforcement discretion on a case-by-case basis, without any categorical “safe harbor”. In exercising their discretion, the Departments noted that they would unlikely pursue enforcement action if a plan or issuer can demonstrate that it would be impossible or difficult to comply with the TiC Final Rules.

The Departments also concluded that the prescription drug machine-readable file requirements under the TiC Final Rules were significantly different than those in the CAA, so there wasn’t an overlap between the requirements, and intend to release future technical guidance with an implementation timeline to sufficiently account for any prior reliance on the deferred enforcement safe harbor.

Expansion of Price Comparison Transparency Tool for 2024

Beginning for plan years on or after January 1, 2024, group health plans and health insurance issuers must expand the internet-based price comparison tool they make available to participants, beneficiaries, and enrollees so that it includes all covered items, services, and drugs (not only the 500 most common shoppable services as required for plan years beginning in 2023).

Employer Action Items

While most employers rely on the carrier or third-party administrator (TPA) to develop and maintain the price comparison tool on their website, to help ensure compliance, employers should consider the following action items:

- Plan sponsor of fully insured health plans. If you have not already done so, obtain written confirmation that the health insurance issuer has agreed to provide the price comparison tool on their website, and provide the related disclosures on paper or over the phone upon request.

- Plan sponsors of self-insured, including level funded health plans. We recommend that you contract with the TPA (or another service provider) to confirm that they are providing this tool and that this responsibility is addressed in a written agreement. In addition, monitor their compliance with this requirement. Unlike fully insured plans, the legal responsibility for this tool stays with a self-insured plan even if its service provider agrees to provide the price comparison tool on your behalf.

Background

The purpose of a price comparison tool is to provide consumers with real-time estimates of their cost-sharing liability from different providers for covered items and services, including prescription drugs, so they can shop and compare prices before receiving care. Upon request, plans and issuers also must provide this information in paper form or over the telephone.

On October 29, 2020, the Departments of Labor (DOL), Health and Human Services (HHS), and the Treasury (collectively, the “Departments”) issued final rules (“TiC Final Rules”) to effectuate this objective. The TiC Final Rules adopted a three-year phased-in approach for implementing its disclosure of cost-sharing information requirements. Phases II and III specifically address price transparency.

- Phase I became effective beginning with plan years on or after January 1, 2022, in which most health plans and issuers of group or individual health insurance (other than grandfathered health plans) were required to begin posting pricing information for certain covered items and healthcare services in separate machine-readable files.

- Phase II became effective for plan years on or after January 1, 2023, and requires health plans to make an internet-based pricing tool available to participants to address the top 500 shoppable items, services, and drugs.

- Phase III is the final phase of this approach and requires that an internet-based pricing tool be made available for the remaining covered items, services, and drugs no later than January 1, 2024.

More information

Additional information is available on the CMS website.

2024 PCORI Fees Announced

The Internal Revenue Service (IRS) has issued Notice 2023-70, which increases the Patient-Centered Outcomes Research Institute (PCORI) fee amount for plan years ending on or after October 1, 2023, and before October 1, 2024, to $3.22 times the average number of covered lives under the plan.

This will apply to 2023 calendar year plans (as well as plans with November and December plan years) that are required to file in July 2024. For non-calendar year plan years that end between January 1, 2023, and before October 1, 2023, the PCORI fee amount is $3.00 multiplied by the average number of lives covered under the plan. For further information, read here.

ACA 2023 Reporting Forms and Instructions Finalized

The Internal Revenue Service (IRS) has released the final 2023 forms for reporting under Internal Revenue Code Sections 6055 and 6056 (Forms 1094-B, 1095-B, 1094-C, and 1095-C), along with related final instructions.

Employer Action Items

Employers should become familiar with these forms and instructions for the 2023 calendar year reporting and, if necessary, begin to explore options for filing ACA reporting returns electronically (e.g., work with a third-party vendor to complete the electronic filing). As a reminder, not only are applicable large employers required to file on the coverage offered to its full-time employees, but small employers with level or self-funded health plans also have a filing requirement under IRC Section 6055 to report coverage information.

Furnishing and Electronic Filing Deadlines

Beginning with filings on or after January 1, 2024, the electronic filing threshold for information returns has been decreased to 10 or more returns (originally, the threshold was 250 or more returns). Accordingly, individual statements for 2023 must be furnished to employees by March 1, 2024, and electronic IRS returns for 2023 must be filed by April 1, 2024.

Several states, including California, Massachusetts, New Jersey, Rhode Island, as well as the District of Columbia, have their own reporting requirements to evidence an employee’s compliance with the individual mandate. Deadlines may differ from the federal law requirements noted in the previous paragraph.

More Information

Final Forms 1094-B and 1095-B and Forms 1094-C and 1095-C are here. Final instructions for Forms 1094-B and 1095-B are available here, and for Forms 1094-C and 1095-C are available here. Also, read our article “ACA Electronic Filing Reminder” in this issue of the Baldwin Bulletin for additional information regarding the new electronic filing threshold.

ACA Electronic Filing Reminder

As noted in the previous article, the 2023 instructions to the Forms 1094 and 1095 include information on the new electronic filing threshold for information returns required to be filed on or after January 1, 2024, which has been decreased to 10 or more returns (originally, the threshold was 250 or more returns). Specifically, the instructions provide the following clarifications and reminders:

- The requirement to file 10-or-more returns electronically applies in the aggregate. Thus, a reporting entity may be required to file fewer than 10 of the applicable Forms 1094 and 1095, but still have an electronic filing obligation based on other kinds of information returns they will be filing (e.g., Forms W-2 and 1099).

- The IRS may grant waivers to the electronic filing requirement upon request, but only in limited circumstances. The IRS still encourages electronic filing even if a reporting entity is filing fewer than 10 returns.

- Employers can use the AIR System to electronically file ACA information returns with the IRS. This system is separate from the system used to file other information returns like Forms W-2.

- When filing forms electronically, the formatting set forth in the “XML Schemas” and “Business Rules” published on IRS.gov must be followed rather than the formatting directions in the instructions, which are intended to assist paper filers only.

Employer Action Items

Employers who are not currently set up for electronic filing should take steps to do so soon, whether on their own or through a third party. Reporting entities that may be in a position to perform their own electronic reporting can review the IRS’ ACA Information Returns (AIR) Program webpage.

More Information

Read here for more information on the electronic filing process and the AIR System, as well as IRS Publications 5164 and 5165.

New HIPAA Penalties Announced

On October 6, 2023, the U.S. Department of Health and Human Services (HHS) published a final rule increasing the civil monetary penalties for violations of the HIPAA Privacy and Security Rules. HHS is required to adjust these penalties for inflation each year to improve their effectiveness and maintain their deterrent effect. The new penalty amounts apply to penalties assessed on or after October 6, 2023.

Employer Action Items

HHS’ Office for Civil Rights (OCR) is responsible for enforcing the HIPAA Privacy and Security Rules. As OCR’s investigations are often triggered by individuals’ complaints to HHS regarding HIPAA violations and breach notification reports, the increased penalties serve as another reminder of the importance for employers who are plan sponsors of HIPAA covered entities or business associates to comply with HIPAA’s Privacy and Security rules.

Employers should review their HIPAA policies and procedures on an ongoing basis to ensure they are up-to-date and regularly conduct training of their employees who handle or potentially handle PHI. Should a plan sponsor or business associate become subject to an OCR investigation that results in a HIPAA violation, to mitigate penalties, the plan sponsor or business associate should consider entering into a remediation agreement, if feasible.

Summary

According to HHS, the compliance problems most frequently reported under HIPAA are:

- Impermissible uses or disclosures of protected health information (PHI).

- Lack of safeguards on PHI.

- Lack of patient access to their PHI.

- Lack of administrative safeguards for electronic PHI.

- Use or disclosure of more than the minimum necessary PHI.

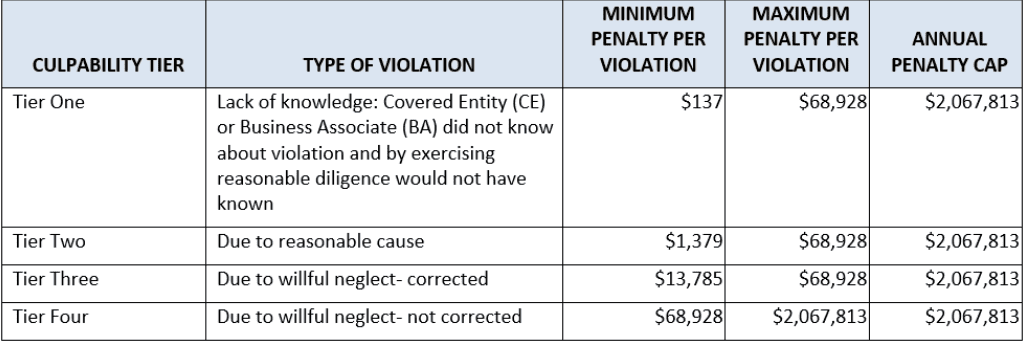

Potential penalties for HIPAA violations depend on the type of violation involved. Penalties are broken down into “tiers” that reflect increasing levels of culpability. Each tier carries a minimum and maximum penalty with an annual cap, all of which have increased as follows:

When the OCR determines that a HIPAA violation has occurred, it will often pursue a resolution agreement rather than impose civil penalties. A resolution agreement typically requires a covered entity or business associate to take corrective action and pay a settlement amount, which is usually much less than the applicable penalty amount.

However, if the covered entity or business associate does not take action to resolve the matter in a way that is satisfactory, the OCR may decide to impose civil penalties. If penalties are imposed, the covered entity or business associate may request a hearing in which an HHS administrative law judge decides if the penalties are supported by the evidence in the case.

More Information

The final rule is available here. Information regarding the HIPAA Privacy and Security Rules, and HIPAA Resolution Agreements can be found here, and here, respectively.

Question of the Month

Question: As an employer and plan sponsor, how do I comply with the Medicare Secondary Payer (MSP) rules?

Answer: The MSP rules include requirements for employers who sponsor group health plans that are primary to Medicare. These requirements are intended to protect Medicare’s secondary payer status. When an employer’s group health plan is primary to Medicare, the employer cannot terminate an employee’s eligibility for coverage when he or she becomes entitled to Medicare. As a reminder, an individual becomes entitled to Medicare when he or she is both eligible for, and enrolled in, the Medicare program.

Employers with group health plans that are primary to Medicare must comply with each of the following requirements:

- The group health plan must provide a current employee (or a current employee’s spouse) who is age 65 or older with the same benefits, under the same conditions, it provides employees and spouses under age 65.

- The employer cannot offer Medicare beneficiaries any financial or other benefits as incentives not to enroll (or terminate enrollment) in a group health plan.

- The group health plan cannot “take into account” the Medicare entitlement of an individual.

Cannot “Take into Account” Medicare Entitlement

Prohibited actions that “take into account” an individual’s Medicare entitlement include (but are not limited to) the following:

- Offering coverage that is secondary to Medicare to individuals enrolled in Medicare.

- Terminating coverage because the individual has enrolled in Medicare (except as permitted for COBRA coverage).

- Imposing limitations on benefits for an individual enrolled in Medicare that do not apply to others enrolled in the plan, such as excluding benefits or charging higher deductibles.

- Charging higher premiums to Medicare-enrolled individuals.

- Requiring Medicare-enrolled individuals to wait longer for coverage to begin.

- Paying providers and suppliers no more than the Medicare payment rate for services furnished to a Medicare beneficiary, but making payments at a higher rate for the same services to an enrollee who is not enrolled in Medicare.

- Providing misleading or incomplete information that would induce a Medicare-enrolled individual to reject the employer’s group health plan, which would make Medicare the primary payer.

- Refusing to enroll an individual for whom Medicare would be the secondary payer when enrollment is available to similarly situated individuals for whom Medicare would not be secondary payer.

No Incentives Permitted

When an employer’s group health plan is the primary payer, employers cannot discourage employees from enrolling in their group health plans. Also, employers cannot offer any financial or other incentive for an individual entitled to Medicare to not enroll (or terminate enrollment) in a group health plan that would pay primary.

Penalties for Noncompliance

Effective October 6, 2023, the indexed amounts for violations applicable to employer-sponsored health plans are as follows:

- $11,162 for offering incentives to Medicare-eligible individuals not to enroll in a plan that would otherwise be primary.

- $1,428 for a responsible reporting entity to fail to provide information identifying situations where the group health plan is primary.

More Information

For more information, please also refer to the MSP website.

Comments are closed.